New Futures on Auction

Last week Monday saw Strauss & Co. break their own record for overall turnover when their summer sale held at the Vineyard Hotel in Cape Town did R70.6m in business. The previous record, set in Johannesburg in 2010 stood at R66.8m.

Such numbers tell a tale of a buoyant market place where established precedents are continually met by receptive buyers and fueled by savvy sellers. As a way of framing some of these highlights I want to make some art historical observations in order to illustrate the character of growth that the secondary market place is currently enjoying.

Pieter Hugo. 2004. Messina/Musina: In Tyrone Brand’s Bedroom. C-print.

This begins by charting three distinct groups of artists according to historical period measured against sale precedents. For the sake of ease I have given each a name which describes their place on a sliding scale of economic success. These are not hard and fast categories, nor are they conclusive but instead represent a noticeable trend in where the market place has come from, how it is currently situated and where it might be going in the future.

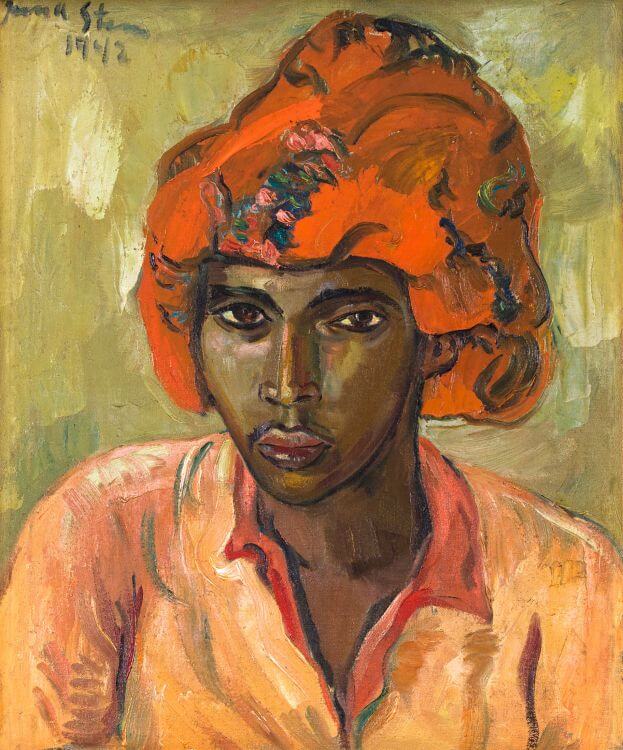

First up you have the Gold Standard; the historic heavy hitters dominated in this sale by the likes of Irma Stern, J.H. Pierneef and Maggie Laubser. The distinguishing factor of this group is the markets willingness to support the mega-estimates that are attached to these artist’s work.

Stern’s Young Arab fetched R13.6m for example, with her Flowers and Fruit coming in at R5.6m. Pierneef, another consistent performer, saw two landscapes going above the R2m point, whilst Maggie Laubser’s portrait of a Shepherd Seated with his Flock almost doubling it’s low estimate coming in at R3.9m.

Irma Stern. 1942. Young Arab. Oil on canvas.

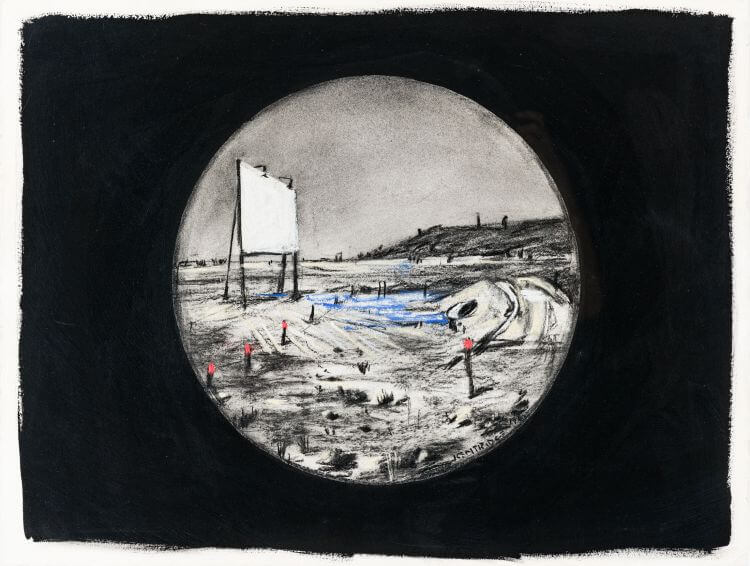

Next up is what one might call Blue Chip stocks; a generation apart from the Gold Standard group, these are consistent performers whose desirability sees them hovering at around the R1m mark. Led by William Kentridge, this includes Robert Hodgins, and Peter Clarke.

As the only living artist on this list William Kentridge is the veritable youngster amoungst his peers. Yet with his reputation as perhaps South Africa’s most visible international artists alive today, his performance is no coincidence. It is worth mentioning that it is his early works that often perform the strongest as his Untitled (Drawing for Felix in Exile) showed when it fetched R1.04m above the low estimate of R800k.

William Kentridge. 1993. Untitled (Drawing for Felix in Exile). Charcoal, pastel and gouache on paper.

Hodgins similarly also proved his collectibility when his painting, An Old Couple doubled its low estimate of 500k to fetch R1m. Likewise was Peter Clarke’s gouache on paper which fetched R909k above the high estimate of R800k.

Then finally is a new category of artists who are beginning to make their presence felt on the secondary market. Due to their relatively new appearance on the auction circuit I term this group the Speculative Contemporaries. Represented by Diane Victor, Wim Botha, Zander Blom, Georgina Gratrix, Mikhael Subotzky and Pieter Hugo, they are all living contemporary artists who have strong careers and good primary market precedents.

It is often the case that if an artist comes to auction too soon then those precedents, so carefully cultivated and indeed jealously guarded by their dealers, can often suffer a correction when faced with the scrutiny (or disinterest) of the open outcry system on the sale-room floor.

Now however there is a noticeable shift where the secondary market is being tested by a new wave of speculation where contemporary art is finding a footing in a landscape previously dominated by generally conservative buying trends. Whilst this group does not necessarily command the enormous prices of their predecessors, it is worth noting that buyers are willing to engage in enough risk to both meet and sometimes exceed their estimates.

Zander Blom. 2015. Untitled 1.698. Oil on unprimed linen.

Take for example Zander Blom’s abstract painting Untitled 1.698 which fetched R272k, over it’s top estimate of R200k. Signed and dated 2015 this is relatively young painting to go under the hammer and suggests that Blom’s desirability is high. And whilst it is generally accepted that printed works in multiples don’t fetch as much as one off originals, this did not stop bids for Diane Victor’s Let Sleeping Croc’s Lie going over its high estimate of 90k to the hammer price of R113k.

Whilst both Webster and Gratrix both came within their estimates with R68k each for their paintings, the real highlight of this Speculative Contemporaries group was held by photography which is not known for its secondary market resilience due to its reproducibility. But this did not stop buyers chasing early works by Hugo and Subotzky. The bidding for Hugo’s special edition artists proof from his Messina/Musina series found itself doubling the high estimate, fetching R125k.

This might not be an infallible method of analysis but these three categories give room to measure both the consolidated growth of the top end of the market place and recognising the solidified strength of the so called blue chip artists. At the bottom end, with the increased speculation over contemporary art on the auction circuit, these figures indicate that new futures can be expected.